India’s electric vehicle revolution isn’t just about the vehicles on our roads—it’s equally about what powers them and keeps them running. The EV spare parts manufacturing sector is experiencing explosive growth, transforming India from an import-dependent market into an emerging global hub for electric vehicle components.

If you’re involved in the EV industry as a manufacturer, dealer, investor, or entrepreneur, understanding this manufacturing boom is crucial. Let’s explore how local production is reshaping India’s electric mobility landscape.

The Demand Surge: Why EV Components Are the Next Big Thing

India’s EV adoption is accelerating at an unprecedented pace, particularly in two-wheelers, three-wheelers, and commercial vehicles. This surge directly translates into massive demand for specialized components that make electric vehicles work.

The numbers tell a compelling story. Industry analysts project that India’s EV component market could surpass ₹150,000 crore by 2030. This isn’t mere speculation—it’s backed by steadily rising EV sales and an expanding network of component suppliers across the country.

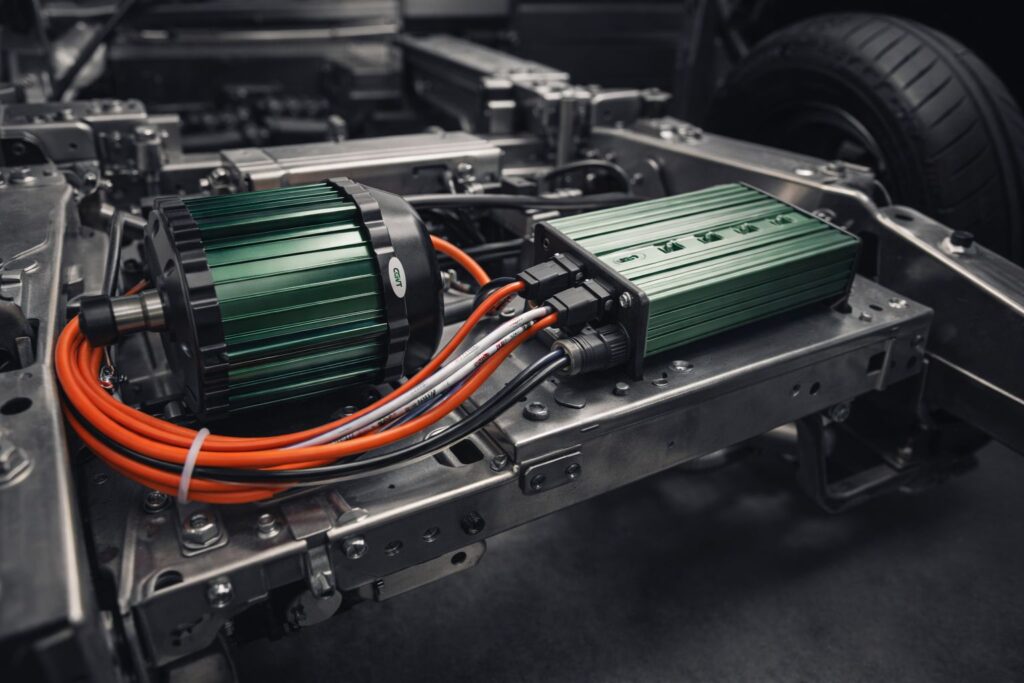

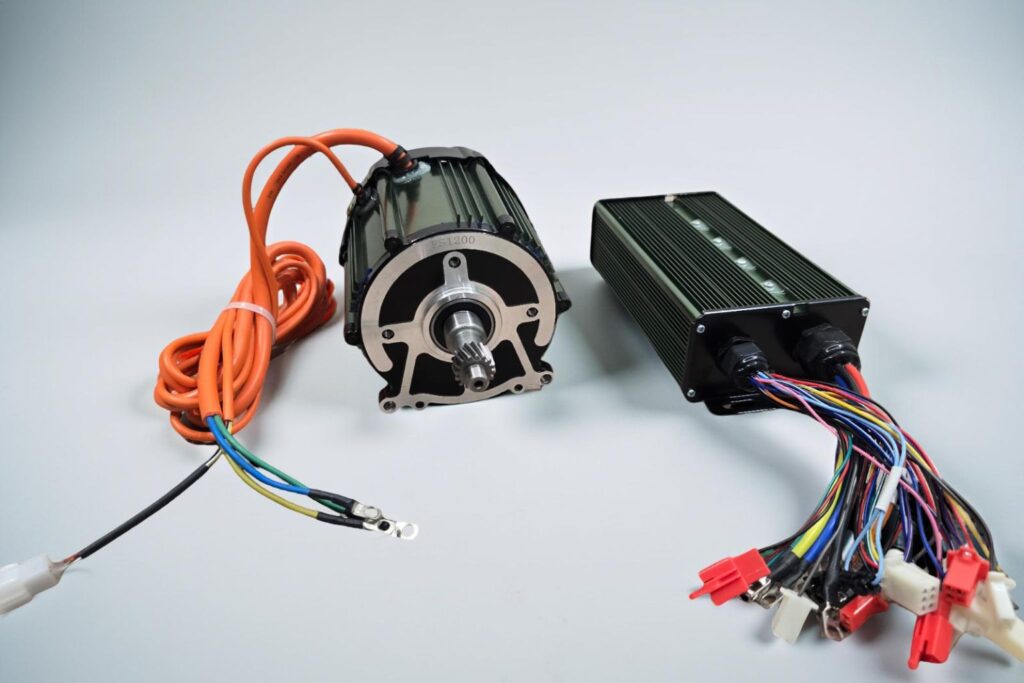

What makes this opportunity unique is the fundamental difference between conventional and electric vehicles. Traditional automobiles rely heavily on mechanical engine parts—pistons, crankshafts, exhaust systems. Electric vehicles, however, depend on high-precision electrical and electronic components: BLDC motors, inverter systems, battery management systems, power electronics, and advanced control modules.

This shift from mechanical to electrical creates entirely new manufacturing opportunities. Companies that previously had no place in the automotive supply chain can now become critical suppliers to EV manufacturers.

Government Support: The Wind Beneath Manufacturing Wings

India’s government has recognized that a thriving EV industry requires a robust domestic manufacturing ecosystem. The policy framework reflects this understanding through multiple supportive initiatives.

Production-Linked Incentive (PLI) Schemes provide substantial subsidies and financial incentives to component manufacturers willing to expand capacity and invest in advanced technologies. These schemes reduce the financial risk for manufacturers entering or scaling up in the EV component space.

FAME (Faster Adoption and Manufacturing of Electric Vehicles) and related programs don’t just encourage EV purchases—they indirectly drive demand for domestically manufactured components. When consumers buy subsidized EVs, manufacturers need more parts, creating steady demand for local suppliers.

Localization mandates requiring higher domestic content in certain EV categories push manufacturers to source components locally rather than importing. This policy approach simultaneously develops local manufacturing capability while reducing India’s import dependence.

The combined effect of these policies is significant: reduced reliance on imported parts, lower manufacturing costs, improved supply chain security, and positioning India as an attractive manufacturing destination for global component makers.

Why Manufacturing in India Makes Business Sense

Beyond government incentives, fundamental economic and strategic advantages make India an increasingly attractive location for EV spare parts manufacturing.

Cost Competitiveness That Matters

Indian manufacturing offers genuine cost advantages that directly impact bottom lines. Studies indicate India can produce many EV components 10-25% cheaper than Western markets, primarily due to lower labor costs, improving infrastructure, and economies of scale.

These savings aren’t marginal—they’re substantial enough to influence global sourcing decisions. Localized production eliminates import duties, reduces shipping costs, and removes currency exchange risks. For both large OEMs and small dealerships, this cost efficiency translates to better margins or more competitive pricing for end customers.

Supply Chain Resilience in an Uncertain World

Recent years have taught businesses painful lessons about supply chain vulnerabilities. The pandemic exposed how dependent Indian EV manufacturers were on imported components, particularly from China. Semiconductor shortages further demonstrated the risks of long international supply chains.

Building a local supplier ecosystem addresses these vulnerabilities directly. Domestic production means shorter lead times, faster response to demand changes, and reduced exposure to international logistics disruptions. For tech-heavy components like battery management systems and power electronics, this responsiveness becomes a competitive advantage.

Employment and the Skilled Workforce Advantage

EV spare parts manufacturing creates substantial employment across multiple skill levels. Production line workers, quality control technicians, R&D engineers, supply chain specialists—each factory expansion generates hundreds of direct jobs and thousands more in supporting industries.

Beyond quantity, these are increasingly skilled opportunities. As manufacturing sophistication increases, so does demand for engineers and technicians trained in advanced electronics, battery technology, and automotive engineering. This creates a virtuous cycle: manufacturing growth drives skill development, which enables even more sophisticated manufacturing.

Innovation Tailored to Indian Needs

Local manufacturers possess something foreign suppliers can’t easily replicate: deep understanding of Indian operating conditions and customer requirements.

Indian roads vary dramatically—from smooth highways to pothole-filled rural paths. Temperatures range from Himalayan cold to Rajasthan heat. Customer priorities emphasize affordability and durability over luxury features. Local manufacturers can design components specifically optimized for these conditions.

This isn’t just about serving the domestic market. Components proven in India’s challenging conditions become attractive for other emerging markets with similar characteristics, creating export opportunities beyond India’s borders.

The Reality Check: Challenges on the Path Forward

Despite impressive growth, India’s EV spare parts manufacturing sector faces genuine obstacles that temper unbridled optimism.

Critical Material Dependencies: India lacks domestic sources for lithium, cobalt, and rare earth materials essential for batteries and motors. This dependency creates vulnerability in the supply chain that localization policies can’t fully address. India must either secure long-term import arrangements or invest heavily in alternative battery chemistries and recycling infrastructure.

Capital Intensity Barriers: Advanced EV component manufacturing—particularly battery gigafactories and semiconductor fabrication—requires enormous capital investment. While large corporations and multinationals can make such investments, smaller Indian manufacturers often struggle to access the capital needed to compete at global scale.

Quality and Standardization: Meeting international quality standards consistently remains a challenge for some Indian manufacturers. For India to become a genuine export hub rather than just serving domestic needs, quality must match or exceed global benchmarks. This requires investment in testing infrastructure, certification processes, and quality management systems.

Technology and IP Constraints: Much of the critical EV technology remains under patent protection or requires licensing from international technology leaders. Developing indigenous technology requires sustained R&D investment and patience for results that may take years to materialize.

However, these challenges aren’t insurmountable. As production volumes increase, economies of scale improve capital efficiency. Government incentives continue evolving to address specific bottlenecks. Quality improvements follow naturally from experience and competition. Each challenge represents both an obstacle and an opportunity for those willing to invest in solutions.

What This Means for Different Stakeholders

The growth of EV spare parts manufacturing creates distinct opportunities across the value chain.

For EV Dealers and Service Centers: Local component availability means faster repairs, reduced inventory costs, and better margins on spare parts sales. Dealers can offer more competitive service packages when parts don’t require expensive imports with long lead times.

For Manufacturers and Suppliers: Whether you’re producing motors, battery components, power electronics, or charging infrastructure, the expanding market offers genuine growth opportunities. The key is identifying specific niches where you can compete effectively, whether through cost, quality, innovation, or service.

For Investors: The component sector offers more diversified opportunities than vehicle manufacturing alone. From specialized electronics to battery recycling, multiple segments present investment potential with varying risk-return profiles.

For Workforce and Students: Growing manufacturing means growing career opportunities in engineering, production management, quality control, and technical sales. Specialized training in EV technologies increasingly translates to strong employment prospects.

The Road Ahead: India’s EV Component Future

India’s journey toward becoming a major EV component manufacturing hub is well underway but far from complete. The next five to ten years will be crucial in determining whether India becomes merely a large domestic market or a genuine global supplier.

Several trends will shape this trajectory. First, expect continued policy support as the government remains committed to both EV adoption and manufacturing growth. Second, watch for increasing consolidation as successful manufacturers scale up while weaker players exit. Third, anticipate growing sophistication in both products and processes as manufacturers climb the technology curve.

International collaboration will likely increase. Rather than purely indigenous development, expect more joint ventures, technology licensing, and strategic partnerships bringing global expertise to Indian manufacturing capabilities. This pragmatic approach can accelerate India’s component sector growth more rapidly than pure self-reliance.

Most importantly, success will ultimately depend on competitiveness. Policy support provides a foundation, but sustainable growth requires Indian manufacturers to compete globally on quality, innovation, and total cost of ownership—not just initial price.

Conclusion: A Strategic Transformation in Motion

The growth of electric vehicle spare parts manufacturing in India represents far more than an industrial trend—it’s a strategic transformation positioning India for the automotive future.

Strong market demand driven by accelerating EV adoption, supportive government policies reducing risk and improving economics, and rising local capabilities in engineering and manufacturing are converging to create a robust component ecosystem.

Challenges remain, certainly. Import dependencies for critical materials, capital requirements for advanced manufacturing, and quality standardization all require continued attention. But the trajectory is clear and positive.

For those positioned to participate—whether as manufacturers, suppliers, dealers, investors, or skilled workers—India’s EV component growth offers genuine opportunities. The question isn’t whether this sector will grow, but rather how to position yourself to benefit from that growth.

The electric vehicle revolution is here. India’s component manufacturing sector is powering it forward, one part at a time.

What’s your experience with EV spare parts? Are you seeing the impact of local manufacturing in your business? Share your perspective in the comments below.